For a long time the insurance industry has been leveraging analytics to understand and predict risk when writing policies. But what happens when a disputed claim becomes a legal matter? Using advanced technologies, Legal Analytics gives you insights into legal cases and trends that were previously unknowable to provide better legal advice, develop better litigation strategies and win more cases.

Data-Driven Strategy

With Legal Analytics, insurance lawyers can discover what types of cases have actually been litigated, who represented the opposing parties, how long the parties litigated, what findings the court or jury made, and what damages were awarded. It can also provide a detailed litigation history of an opposing party, allowing counsel to understand the party’s strategies and litigation outcomes. Using that information, both in-house counsel and their law firms will be much better equipped to predict how long a case may take, how much it will cost, what damages might be expected, what strategy their opponent might employ, what strategy is likely to be successful, and many other important considerations.

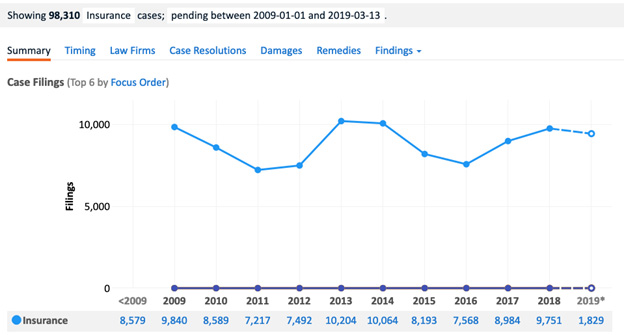

Lex Machina’s Legal Analytics for Insurance Litigation brings data-driven insights to insurance cases pending in Federal District Court from 2009 to the present. The module includes over 98,000 cases (including class actions) involving disputes between an insurer and a policyholder, a beneficiary, or another insurer asserting the rights of a policyholder. It covers a broad spectrum of policy types including home, life, auto, commercial and professional liability, health, disability income, and many more, with the exception of Medicare, Social Security, surety bonds, annuities and ERISA claims.

Unique Policy Type Differentiation

Lex Machina’s Legal Analytics includes coding for the most common types of insurance policies, but its word search function can uncover cases involving many other niche policy types including fire, flood, and cyber security — which can be analyzed separately. These policy type codes, combined with 50 other case tags covering findings, damages and remedies, give users the ability to locate and analyze cases involving issues of interest and the relevant type of policy.

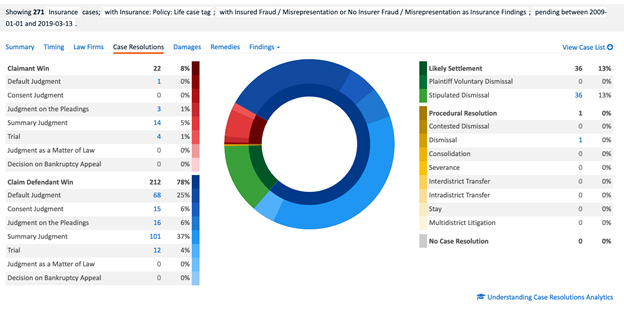

For example, let’s assume I am counsel to a beneficiary of a life insurance policy, the insured has died, and the insurer has refused to pay the policy benefit because it asserts that the insured misrepresented his health on the application for insurance. By selecting the appropriate case tags, I can easily identify the cases involving a life insurance policy in Federal District Courts in which the court made a finding on the issue of fraud or misrepresentation by the insured. The results of my search look like this.

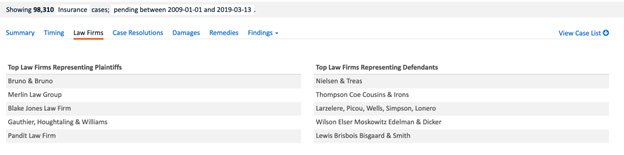

Evaluate Counsel or Competition

Having instant access to cases, resolutions, case timing, damages, and the track records of opposing counsel, parties and judges, is a game-changer for the insurance industry. Using analytics, attorneys for the insured or the insurer can get a clear picture of what it looks like to litigate a particular case and formulate business and legal decisions from a position of knowledge.

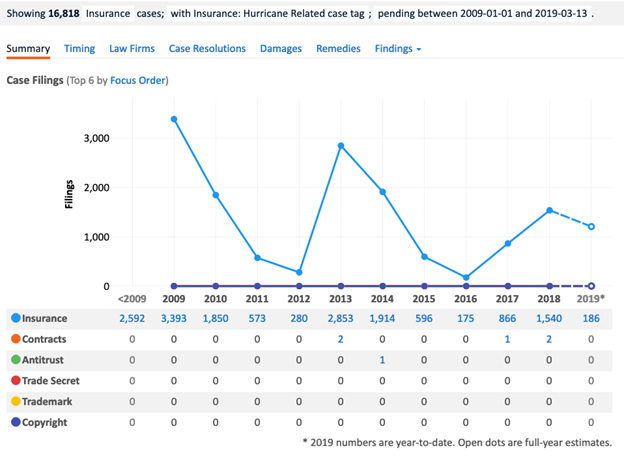

Legal Analytics can also be used to identify broad trends in insurance litigation in the Federal Courts. For example, carriers and their counsel are vitally interested in knowing whether Federal Court insurance case filings are increasing or decreasing over time. For carriers, having accurate claim and case filing data is vital to project and assess future risks and to make sure they are equipped to handle claims and cases effectively. Law firms can use the technology to better predict and support their clients’ legal needs. For example, the chart below shows the total number of insurance cases filed each year in the Federal District Courts that are hurricane-related.

Gain Strategic Advantage

Legal Analytics is rapidly becoming a must-have tool to help companies and their counsel make smarter, faster, data-driven business and legal decisions. Without a doubt, the technology is having a profound impact on the way that corporations and their law firms approach the practice of law. All parties in the insurance industry stand to benefit greatly from the use of Legal Analytics given the scope and complexity of insurance cases and the breadth of the types of policies available in the market today. Insurance law firms also will make increasing use of Legal Analytics in order to become better lawyers and new applications for Legal Analytics in the insurance industry likely will emerge. In the meantime, in an industry that already relies heavily on data and predictive analytics models to assess risk, Legal Analytics should be a welcome addition to the existing tool sets of insurers, insured, and their counsel.

This is a condensed version of the article “Legal Analytics: ‘Must-Have’ Tool Assists Carriers in Data-Driven Legal Decisions and Success in Litigation ” from the Insurance Advocate® – Vol. 129, No. 15, September 24, 2018.

Find out more! Specific insights like these are available in Lex Machina’s Insurance Litigation Report .

Ron Porter is a Legal Data Expert at Lex Machina, a LexisNexis company. Prior to joining Lex Machina in 2016, Ron spent 30 years as a member of the General Motors legal staff where he practiced product liability law and represented the company in insurance litigation and arbitrations. Prior to working at General Motors, Ron practiced law at a midsize firm in Detroit, handling personal injury, commercial and insurance litigation. He is a graduate of the University of Michigan Law School and a member of the Michigan Bar Association.