Legal Analytics for Consumer Protection

Lex Machina’s Legal Analytics for Consumer Protection Litigation enables attorneys and companies to make data-driven decisions about federal consumer protection case strategy and tactics. Now you can use quantified insights into the behavior of district court judges, opposing parties, and opposing counsel to gain competitive advantage in consumer protection litigation.

Lex Machina’s consumer protection data lets you analyze federal consumer protection case timing, resolutions, damages, remedies, and findings. Our case set covers three major areas of law: consumer finance, unfair or deceptive trade practices, and data breach. Consumer finance includes litigation over debt collection, credit reporting, truth in lending practices, and other related state and federal statutes. Unfair or deceptive trade practices cover federal and state statutes involving fraud, deception, abuse of consumer information, government enforcement actions, and consumer privacy. Data breach concerns the inadvertent or unauthorized disclosure of consumer data.

Use Cases

Lex Machina helps you answer questions such as:

- How many FDCPA cases have awarded Punitive Damages since 2009?

- How long does it take a judge to rule on class certification in a particular district?

- Which law firms have the most experience representing plaintiffs in TCPA cases?

- Who are the top defendant parties in data breach cases filed from January 1, 2017 to present?

- What are your chances of success with a motion for summary judgment in a FCRA case?

- What are the largest Civil Money Penalties awarded in cases brought by the FTC?

Case Tags

Data Breach, Fair Debt Collection Practices Act (FDCPA), Fair Credit Report Act (FCRA), Truth in Lending Act (TILA), Telephone Consumer Protection Act (TCPA), FTC / CFPB Enforcement, and Unfair / Deceptive Trade Practices

Damages Categories

Statutory Damages, Enhanced / Trebled Damages, Compensatory Damages, Punitive Damages, Restitution, Civil Money Penalties, Settled Claim Damages, and Approved Class Action Settlement

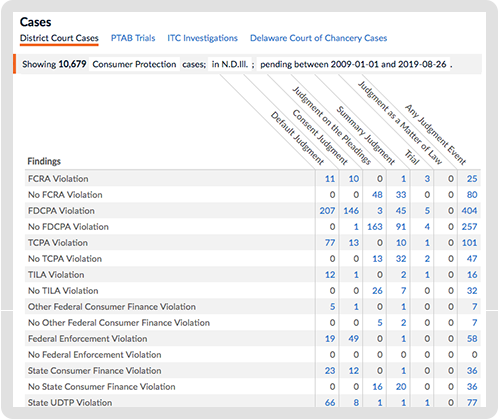

Findings

Violation Findings: FDCPA Violation, FCRA Violation, TILA Violation, TCPA Violation, Data Breach: Notification/Handling Violation, Data Breach: Contract Violation, Other Federal Consumer Finance Violation, State Consumer Finance Violation, Fraud, Negligence, Federal Enforcement Violation, State UDTP Violation, Willfulness, and Bad Faith Prosecution

Class Certification Findings: No Class Representative Standing, No Ascertainable Class, No 23(a)(1) Numerosity, No 23(a)(2) Commonality, No 23(a)(3) Typicality, No 23(a)(4) Adequate Representation, and No 23(b)(3) Predominance and Superiority

Defense Findings: Bona Fide Error Defense, Common Law or Equitable Defense, Good Faith Reliance Defense, Other Statutory Defense, No Data Breach: Standing, and Time-Barred Defense

Remedies

TILA Rescission. Other Remedies include Granted and Denied Permanent Injunction, Preliminary Injunction, and Temporary Restraining Order

How Can You Apply Legal Analytics?

Set litigation strategy: What are your chances of success with a motion for summary judgment in a FDCPA case; how often and how long does it take for a court to rule on class certification; what arguments have been successful in making claims for lack of standing; what strategies work when making, or defending, a claim for civil money penalties?

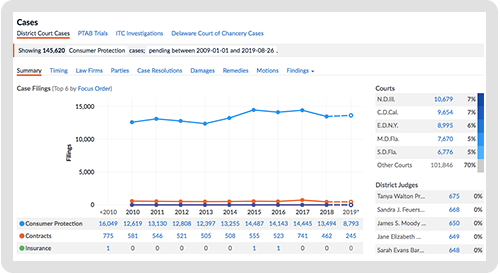

Venue and judicial analysis: The most prevalent districts for consumer protection litigation look different depending on which causes of action are being asserted within the case. For cases involving the Fair Credit Reporting Act and the Truth in Lending Act, the most active district is the Central District of California. Whereas, Fair Debt Collection Practices Act cases were filed most often in the Eastern District of New York.

Competitive intelligence: Evaluate your opposing counsel, including their prior cases, to see their typical playbook, anticipate their motion and case strategies, and then set the best course of action based on your analysis of their trial, settlement and motion strategy. Are they real fighters or imposters?

Early case assessment: Determine in two clicks the threat level, how long a case may take, and what the likely outcome is. Find out which lawyers and law firms are experienced in the first stages of consumer protection litigation, and which lawyers have taken a case all the way to trial.

Industry trending: Gain insights into consumer protection trends, damage awards, timing and settlement patterns in consumer protection litigation or among a select group of peers or competitors. In one click, see the law firms with the most experience in consumer protection litigation and perform spot-checks for conflicts.

Select or evaluate your outside counsel: Compare the performance of select law firms in geographic areas, in areas of expertise, or before certain judges. Find the best counsel for your case, even if they aren’t in your sights, based on factors important to you and your case.