Lex Machina is excited to add over 60,000 cases to our Legal Analytics platform with a new module for commercial litigation. Commercial litigation is the business mainstay of many firms, a concern for nearly any corporation, and a big step for Lex Machina towards making Legal Analytics available across the law.

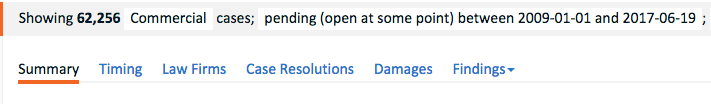

This blog post takes a preliminary look at these cases, and begins by examining the broad overlap of commercial litigation with other practice areas. Next, we look at how commercial litigation is spread across the districts around the country, and why no single district has more than 10% of commercial litigation. Given the wide distribution of these cases, we conclude with an example of how practitioners working in new or unfamiliar jurisdictions can analyze judge behavior.

Commercial overlap with IP and securities

Commercial litigation, which Lex Machina defines as cases between business on breach of contract or business tort claims, is the single largest federal practice area.

However, about 20% of these commercial cases pending since 2009 also involve an intellectual property claim (patent, trademark, or copyright). Securities and antitrust cases comprise an additional 5%.

Overlap of commercial cases pending since 2009 with other practice areas

The overlap with other practice areas means that lawyers working on commercial cases may be thrust into these contexts, and in less familiar scenarios the advantages provided by Legal Analytics are significant. For current Lex Machina customers, the new module can unlock additional analytics on existing IP cases with commercial claims.

Top districts

Patent litigation is heavily concentrated in the Eastern District of Texas; to a slightly lesser extent securities litigation is concentrated in the Southern District of New York. Even in trademark and copyright litigation both, the top district, the Central District of California, has a double-digit percentage of cases and healthy lead over the second-ranked district.

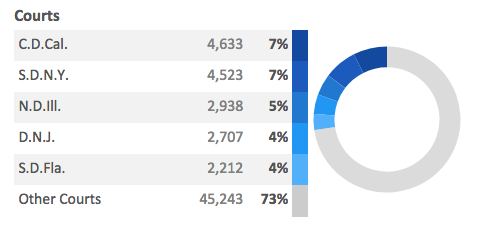

Commercial litigation is different because it is far more spread out. Among cases pending since 2009, no single district has a strong lead. Rather, the Central District of California and the Southern District of New York are nearly tied for top rank, with each accounting for about 7% of the cases. From there, the top other districts include the Northern District of Illinois, the District of New Jersey, and the Southern District of Florida.

Top commercial districts

Judge analysis: timing and motion metrics

For law firms and companies with national reach, the distribution of cases across so many districts also increases the odds of being in less familiar jurisdiction or before an less familiar judge.

When faced with relative unknowns from a court or judge, Lex Machina helps practitioners to rapidly size up the relevant metrics.

Across the top of each case list on the Lex Machina site, there are tabs for analytics related to courts represented in that list – for example, the courts as well as law firms, case resolutions, findings, and damages. This post considers another item among that list: case timing.

Knowing the timing of key events in a case helps lawyers better estimate the cost and risk of litigation, and to budget accordingly. For example, consider two different judges one might be before in the Central District of California.

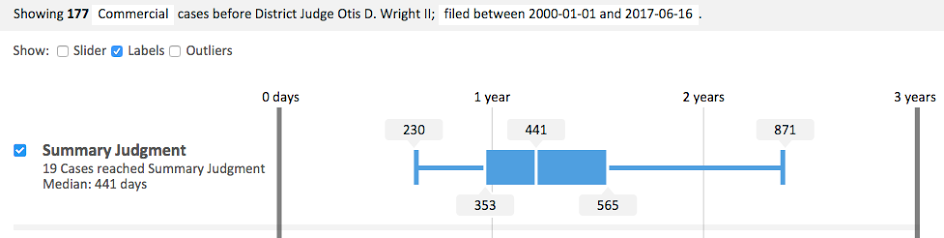

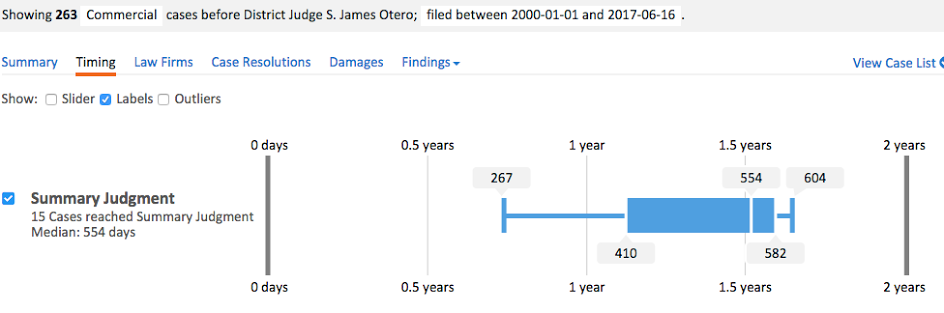

Judge Wright is nearly 3 months faster to summary judgment in Commercial cases, with a median of 441 days, than Judge Otero, whose median is 554 days.

Timing for Judge Wright, summary judgment

Timing for Judge Otero, summary judgment

Both are fairly consistent though: half the time, Wright is between 12 and 18 months; for Otero, half the time it’s between 14 and 20 months.

Looking at motion metrics for these cases, we see that Judge Otero only grants SJ 32% of the time, while Judge Wright has a grant rate of 57%.

Lex Machina can also help practitioners compare the judges on motions practice. The motion metrics report (shown below for Judge Wright), shows that Wright grants more than half (53%) of the summary judgment motions before him in commercial cases – slightly more than the national average.

In contrast, Judge Otero’s grant rate is only 32%, and is lower than the national average (which is 42%).

Conclusion

Because of its broad overlap with IP and its wide spread across districts, commercial litigation is an aspect of many litigators’ practice. Lex Machina brings commercial practitioners the ability to find the cases that matter, in the right districts, and the power quickly turn that information into advantage.

Although Lex Machina will release a full report on commercial litigation in August, subscribers can begin accessing and exploring the right now!