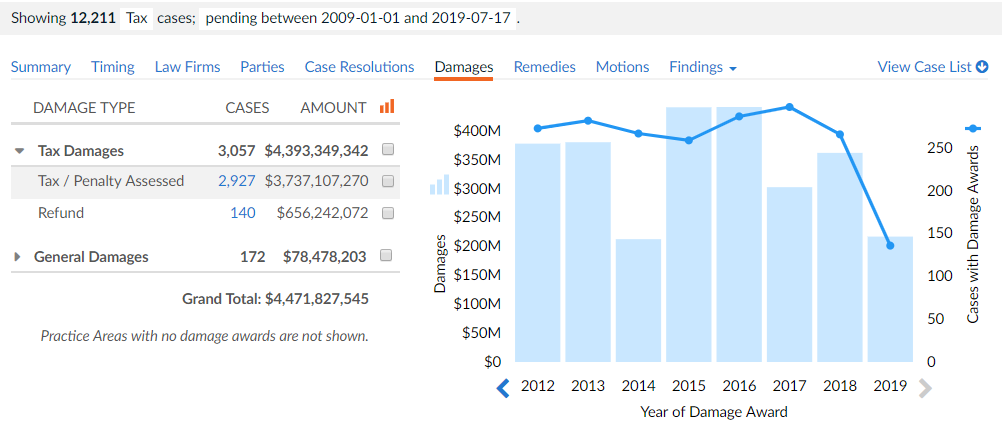

The Lex Machina team is excited about the launch of our Tax Litigation module including over 12,200 tax cases pending in federal district court since 2009. This module covers cases involving a dispute over tax liability, tax preparation, or a tax lien or levy on property.

Use legal analytics to find out whether a judge has experience hearing tax cases in federal district court or how IRS counsel’s cases have resolved in the past. Lex Machina’s data includes information on case filings, timing, case resolutions, findings, damages, law firms, and parties.

Highlights in this area include case-type specific tags:

IRS Summons – Tax cases involving a motion to enforce or motion to quash a summons issued by the IRS in a tax-related matter.

Partnership Items – Tax cases in which a partnership taxpayer seeks to have its partnership items readjusted by the IRS, thereby reallocating tax responsibility between the partnership and the individual partners.

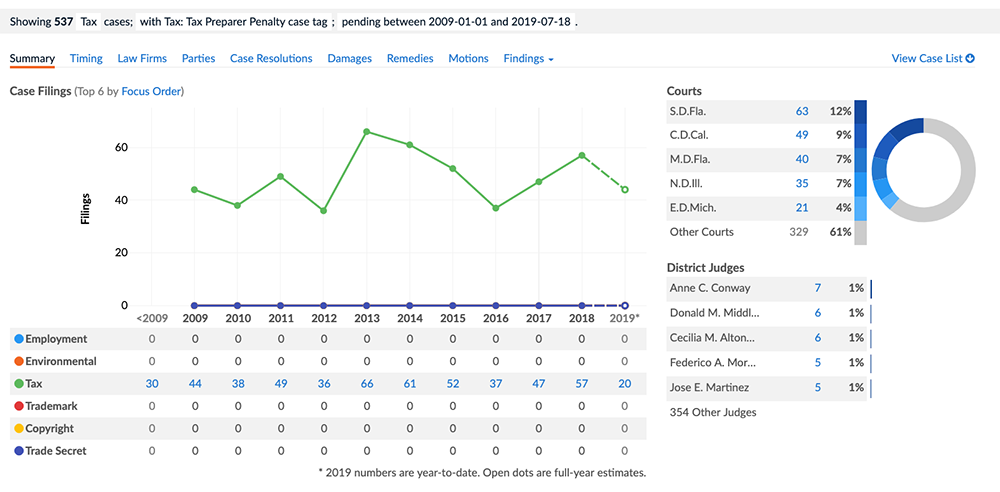

Tax Preparer Penalty – Tax cases in which the IRS seeks to penalize a tax preparer for fraudulently or negligently prepared tax returns. These cases typically result in a permanent injunction against the tax preparer.

Tax litigation data helps lawyers on both sides make better strategic and tactical decisions during litigation. From detailed metrics on motions practice, to case timing and budgeting, legal analytics can provide an edge over the competition.

To find out more information, join us for a webcast on July 23rd at 10:00 a.m. Pacific Time. Legal Data Expert, Anne Wise Kann, will be demonstrating the new practice area.

To register for the webcast, please click here.