Legal Analytics for Tax Litigation

Lex Machina’s award-winning Legal Analytics platform is now available for tax litigation in federal district court. These tax disputes include claims filed by the United States for delinquent taxes, claims filed by taxpayers for refunds, actions to enjoin fraudulent or negligent tax preparation services, and more.

Legal Analytics provides data-driven insights and trends in tax case timing, resolutions, damages, and findings. Tax cases are federal district court cases involving a dispute over tax liability, tax preparation, or a tax lien or levy on property. Note that this case type includes only cases in federal District Court, not Tax Court or the Court of Federal Claims.

Use Cases

Lex Machina helps you answer questions such as:

- How much experience does a specific judge have hearing tax-related matters in District Court?

- Which law firms have the most experience representing taxpayers in refund cases in the District of New Jersey?

- How often do judges in a given district award tax or penalty damages in cases brought by the IRS?

- What are a taxpayer’s chances of prevailing on a motion for summary judgment in a refund case?

- How long can a litigant expect to wait for a tax case to go to trial before this judge?

Case Tags

IRS Summons, Tax Preparer Penalty, Partnership Items

Damages Categories

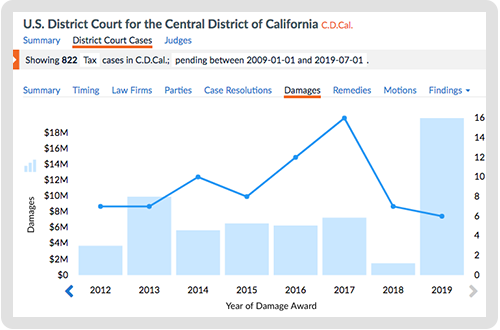

Tax / Penalty Assessed, Refund.

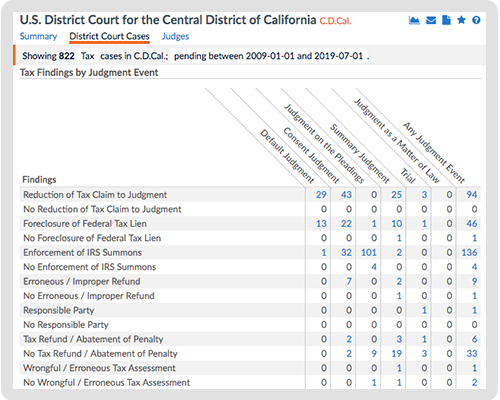

Tax Findings

Reduction of Tax Claim to Judgment, Foreclosure of Federal Tax Lien, Enforcement of IRS Summons, Valid Lien, Erroneous / Improper Refund, Tax Refund / Abatement of Penalty, Wrongful Levy, Wrongful / Erroneous Tax Assessment, Unlawful Disclosure, Fraud, Negligence, Readjustment of Partnership Items, Responsible Party, Quiet Title, Tax Exempt, IRS Statute of Limitations Defense, Estoppel, Failure to Follow Proper Procedural Requirements, Failure to Exhaust Administrative Remedies, Standing.

How Can You Apply Legal Analytics?

LAW FIRMS

Business development: create winning presentations that showcase your specific expertise in tax matters, your early case assessment skills and case results. Respond more quickly than your competition, and with real data, about the judge and jurisdiction, your case strategy or your experience.

Competitive Intelligence: evaluate your opposing counsel, including their prior cases, to see their typical playbook, anticipate their motion and case strategies, and then set the best course of action based on your analysis of their trial, settlement and motion strategy. Note that various attorneys appear on behalf of the IRS and their strategy may differ, so individual attorney information may be more relevant than law firm information in this vertical.

Set litigation strategy: What are your chances of success with a motion for summary judgment in a case for a taxpayer refund. How often, and how long does it take the federal government to settle cases involving tax disputes?

Venue and judicial analysis: Different venues or judges will have different levels of familiarity with certain types of Tax claims. For example, case involving enforcement of an IRS summons are seen slightly more often in the Central District of California than in any other District Court. However, cases involving potential penalties for tax preparers are heard in the Southern District of Florida 12% of the time, whereas the Central District of California is the next most active district with only 9% of cases.

COMPANIES

Early case assessment: Determine in two clicks the threat level, how long a case may take, and what the likely outcome is. Find out which lawyers and law firms are experienced in the first stages of tax litigation, and which lawyers have taken a case all the way to trial.

Industry trending: Gain insights into tax trends, damage awards, timing and settlement patterns in tax litigation or among a select group of peers or competitors. In one click, see the law firms with the most experience in tax litigation and perform spot-checks for conflicts.

Select or evaluate your outside counsel: Compare the performance of select law firms in geographic areas, in areas of expertise, or before certain judges. Find the best counsel for your case, even if they aren’t in your sights, based on factors important to you and your case.

Manage outside counsel: Share insights and data used to evaluate your counsel’s strategy. Determine motion strategy and reduce litigation costs. Use real data to quantify, validate, and support your decisions.

Develop litigation strategy: Get data and statistics to back up a motion for an administrative remand. Determine a judge’s grant rate for injunctions. Determine previously successful arguments for a particular judge. Evaluate how long a case is likely to last. Analyze expected outcomes; predict litigation costs.