Legal Analytics for Security Litigation

Lex Machina’s Legal Analytics for Securities Litigation enables attorneys and companies to make data-driven decisions about federal securities case strategy and tactics. Now you can use quantified insights into the behavior of district court judges, opposing parties, and opposing counsel to gain competitive advantage in securities litigation.

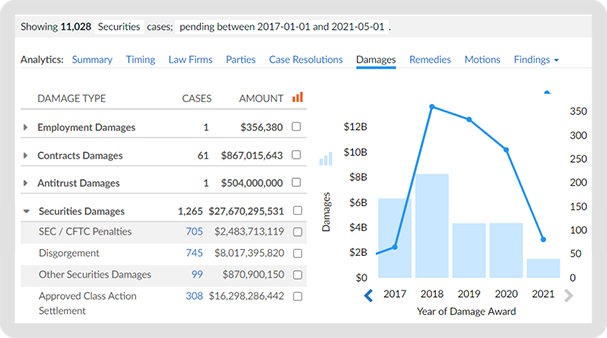

Lex Machina’s Securities data lets you analyze federal securities case timing, resolutions, damages, remedies, and findings. The Securities practice area includes cases with one or more claims of securities law violation brought under the Securities Act of 1933, the Securities Exchange Act of 1934, or other federal securities laws. Review SEC enforcement cases, approved class action settlements, and more.

Use Cases

Lex Machina helps you answer questions such as:

- Has my judge ever awarded disgorgement damages in a securities case? If so, how much was awarded?

- Which law firms have the most experience representing plaintiffs in shareholder derivative suits? Did those firms take similar cases to trial?

- Has my judge ever found there was no Exchange Act violation during a judgment on the pleadings? What were the facts of that case?

- Has the SEC received an approved class action settlement against a party similar to my client? If so, how much was the amount?

- Has my judge ever granted a motion for summary judgment based on the plaintiff knowledge defense?

Case Tags

CFTC Enforcement, SEC Enforcement: Contested, SEC Enforcement: Settled Complaint, Securities Fraud (§ 10(b) / 10b-5), Shareholder Derivative Suit

Damages Categories

SEC / CFTC Penalties, Disgorgement, Approved Class Action Settlement, and Other Securities Damages, Other / Mixed Damages, Attorneys’ Fees / Costs, Prejudgment Interest

Findings

Securities Act Violation, Exchange Act Violation, Other Securities Violation, Statute of Limitation Defense, Plaintiff Knowledge Defense, Cautionary Language / Safe Harbor Defense

Remedies

Granted and Denied Permanent Injunction, Preliminary Injunction, and Temporary Restraining Order