Lex Machina is proud to release its 2021 Securities Litigation Report, which examines securities litigation trends in federal district court. This report focuses on the three-year period from 2018 to 2020 and includes analysis of emerging trends, including cryptocurrency cases and the impact of COVID-19.

Key Trends and Highlights:

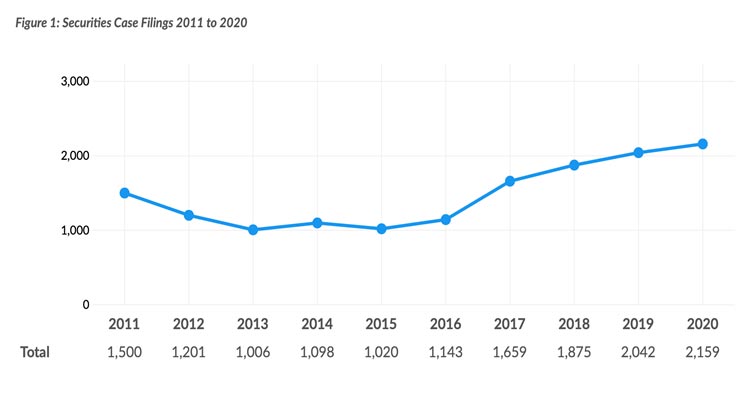

- Yearly securities case filings as a whole, and shareholder derivative cases in particular, have increased steadily since 2016, reaching a total of 2,159 securities cases filed in 2020 (an 89% increase since 2016).

- Cases involving cryptocurrencies sharply increased since 2016, with 113 filed in 2020.

- Over the last three years, the most securities cases were filed in the Southern District of New York (1,294 cases); however, Judge Stark, from the District of Delaware, heard the highest number of securities cases (242 cases). The top four most active judges were in the District of Delaware.

- The Securities and Exchange Commission (the “SEC”) appeared as the plaintiff in 760 cases over the last three years. The most active defendants in securities cases over the last three years were banks and financial institutions, with J.P. Morgan Securities LLC appearing as the defendant in the most cases (63 cases) over the same time period.

- Over the past three years, the Securities and Exchange Commission topped the most active plaintiffs’ firms with 710 securities cases filed, followed by Rigrodsky Law with 534 cases. Skadden, Arps, Slate, Meagher & Flom appeared most often on behalf of defendants in securities cases filed over the last three years, with 172 cases.

- The total damages awarded increased from nearly $4.0 billion to $4.2 billion between 2019 and 2020. The securities case with the largest amount of damages awarded in 2020 was Securities and Exchange Commission v. Telegram Group Inc. et al, with $1.2 billion in disgorgement damages and $18.5 million in SEC/CFTC Penalties on consent judgment.

View our infographic.

Legal Analytics is used for planning, forecasting, and litigation strategy. The metrics in this report may help readers examine who to pursue as clients, how long a matter may take, or when to settle. This research supplements traditional legal research and anecdotal data in order to gain a competitive edge in litigation.

Lex Machina hosted a webcast to discuss the report on April 29, 2021 with Susan Saltzstein (Partner and Co-Deputy of Skadden’s nationwide Securities Litigation Group), Jonathan Schorr (Managing Director and Senior Counsel in the Litigation and Regulatory Proceedings Group at Goldman Sachs), Laura Hopkins (Legal Data Expert at Lex Machina and report author), and Gloria Huang (Legal Content Associate at Lex Machina). View a recording of the webcast.

Request a copy of the report.

Already a user? Find our reports in the Help Center.