Lex Machina is excited to release its 2022 Insurance Litigation Report, which examines insurance litigation trends in federal district and appellate courts. It focuses on the five-year period from 2017 to 2021 and surveys emerging trends in case filings, venues, judges, law firms, parties, timing metrics, case resolutions, findings, and damages. This report includes analysis of cases concerning auto insurance, homeowners insurance, business interruption insurance, and more.

Key Trends and Highlights:

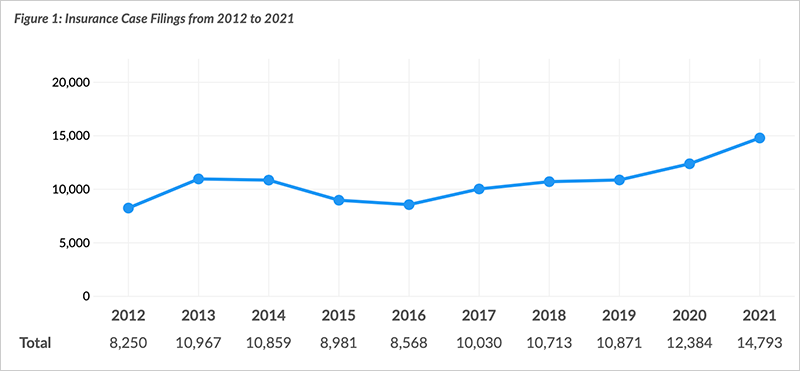

- In 2021, insurance case filings reached a record 14,793 cases, which was a 47% increase in case filings over the last five years (2017-2021).

- Business interruption cases peaked in 2020, but a significant number of cases continued to be filed in 2021.

- In 2021, 26% of all insurance litigation in federal district courts was hurricane-related.

- From 2017 to 2021, the Southern District of Florida heard the highest number of insurance case filings with 4,084 cases, while the Ninth Circuit heard the highest number of appeals with 647 appeals docketed.

- Despite the fact that State Farm separates its automobile coverage and fire and casualty coverage into two separate companies, both companies were the most active defendants, each with over 1000 cases more than the next most active defendant.

- The most active plaintiffs’ law firm was Pandit Law, and the most active defendants’ law firm was Butler Weihmuller Katz Craig.

- Insurance cases that were appealed and received a decision on the merits of the appeal were reversed 25% of the time.

In 2021, over $157M damages were awarded in 123 cases.

View our infographic.

Request a copy of the report.

Already a user? Find our reports in the Help Center.