Lex Machina is proud to release its 2024 Securities Litigation Report, which provides insights into securities litigation trends in federal district court and appellate court over the three-year period from 2021 to 2023. This report surveys emerging trends in case filings (including federal appellate cases), most active venues, judges, law firms, attorneys, parties, timing metrics, case resolutions, findings, and damages. The report often focuses on different sets of data, e.g., filtering cases in order to provide analytics on general securities cases, shareholder derivative suits, class action securities cases, cryptocurrency cases, SPAC cases, and securities appellate cases.

Key Trends and Highlights from the report include:

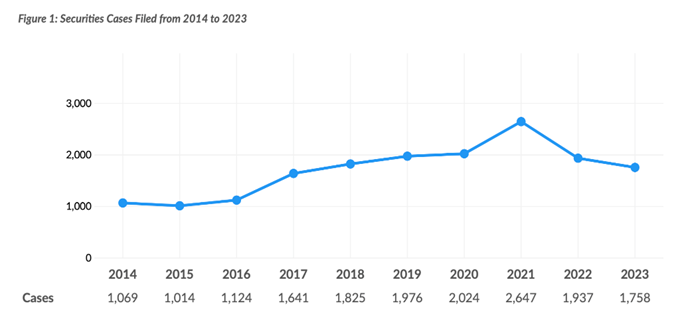

- In 2023, 1,758 securities cases were filed in federal district courts.

- In the three-year period from 2021 to 2023, the highest number of securities cases was filed in the Southern District of New York, while Judge Noreika from the District of Delaware was the most active judge for securities cases.

- A large bulk of the most active plaintiffs were individual litigants, while banks and financial institutions dominated the most active defendants.

- Latham & Watkins represented defendants in the highest number of securities cases filed in the three-year period from 2021 to 2023.

- For securities cases that were appealed to a federal appellate court and terminated from 2021 to 2023 with a decision on the merits of the appeal, 26% were ultimately reversed.

- $11 billion in total damages were awarded as Approved Class Action Settlements from 2021 to 2023.

Legal Analytics is used for planning, budgeting, and litigation strategy. The metrics in this report can help readers decide who to pursue as clients, whether to file a particular motion, or when to settle (and for how much). This research supplements traditional legal research and anecdotal data in order to gain a competitive edge in litigation.

Request a copy of the report.

Already a user? Find our reports in the Help Center.