Lex Machina has released its first Consumer Protection litigation report. Looking at litigation in federal district court from 2009 to 2018, this is a comprehensive overview of trends and insights for making strategic litigation decisions.

A “Consumer Protection” case, as defined by Lex Machina, alleges at least one of the following federal consumer protection statutes: the Fair Debt Collection Practices Act, Fair Credit Reporting Act, Truth in Lending Act, Telephone Consumer Protection Act, or a federal consumer protection enforcement statute, such as the Federal Trade Commission Act or Consumer Financial Protection Act.

This report includes data-driven insights into the behavior of courts, judges, parties, law firms, and lawyers. Legal analytics is used for planning, business development, and litigation strategy. The metrics in this report may help readers decide whom to pursue as clients, which claims to include in a complaint, or when to settle. This research supplements traditional legal research and anecdotal data for a competitive edge in litigation.

Highlights include:

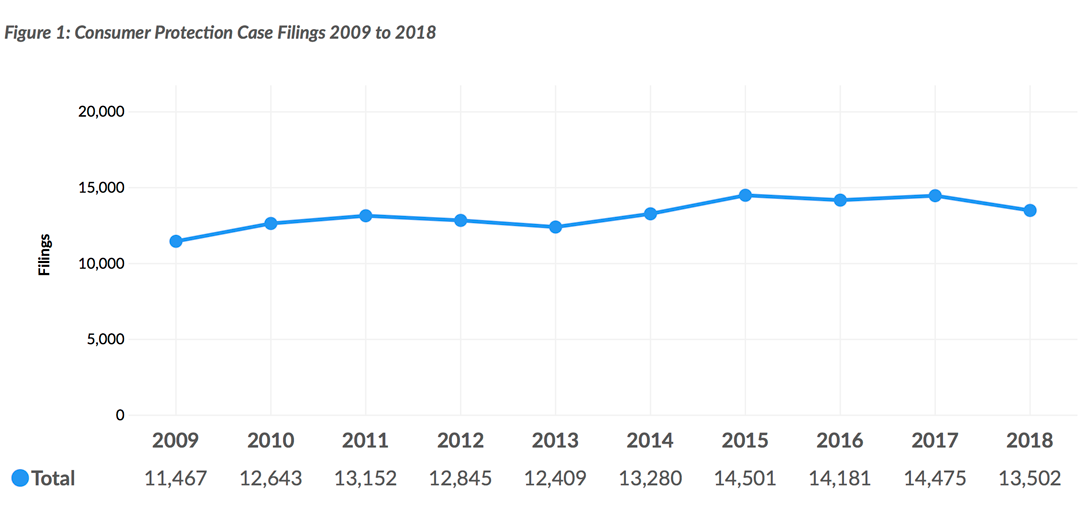

- Consumer Protection is a large practice area with between 11,000 and 14,500 cases filed each year.

- Looking at specific consumer protection claims there are some stark trends. FCRA cases more than doubled from 2009 to 2018. Inversely, TILA case filings have been on a steep decline since 2009.

- The most active district from 2016 to 2018 was the Eastern District of New York, which had the largest number of class action suits in the Consumer Protection practice area. The second most active district was the Northern District of Illinois and the Middle District of Florida was third.

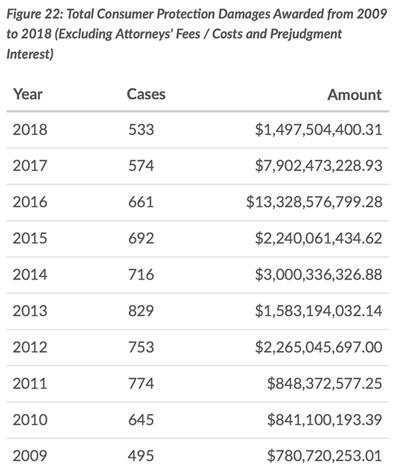

- Volkswagen paid more than $14 billion in consumer protection damages for its “clean diesel” claims.

- The largest consumer protection class action settlement awarded from 2016 to 2018 was $142 million in Jabbari et al v. Wells Fargo & Company.

- The top plaintiffs’ law firm was Atlas Consumer Law with 1,593 cases filed from 2016 to 2018, up from only five cases filed in the three-year period from 2010 to 2012.

- The most active defendants were credit reporting companies: Equifax, Experian, and TransUnion. In the three-year period from 2016 to 2018, more than 4,000 cases were filed against Equifax Information Services, LLC.

Request a copy of the report here.